Green Finance

Proposal for government-backed green loans scheme

25 Oct 2021

Six million UK small businesses contribute just under half of the UK’s carbon emissions generated from business and industry. Prior to COP26 in November 2021, the UK government needs tangible new products to address the environmental impact of small businesses.

Our proposal supports the UK government’s ambitions to be a world-leader in Green Finance; to meet its promises under point 10 of the Ten Point Plan for a Green Industrial Revolution; and to help small businesses meet their obligations under the Government’s PPN 0621 re: Net Zero Carbon Procurement.

We propose a government-backed ESG (Environmental, Social, Governance)-related commercial lending scheme for small businesses. Our proposal is for such a scheme to be on competitive and commercial terms, with commercial lenders taking on at least 50% of the credit risk. Our aim is to maximise the institutional funding available for small businesses for ESG-related purposes, and to ensure that the widest possible range of small businesses can access such funding from a diverse range of commercial lenders in the SME finance ecosystem.

1. The problem to solve

The British Standards Institution survey found just 20% small businesses have committed to a net-zero target, in contrast to 50% of larger businesses. For many small businesses, environmental responsibility is seen as an additional and unnecessary cost. There has not been the right financial product for SMEs that marries commercial competitiveness with ESG-related benefits.

Akin to the current funding gap that exists in SME finance, there is also a lack of finance available to businesses who want to invest in improving their ESG performance. This investment is necessary to enable more sustainable business operations, value chains, products and services.

The above mentioned supply deficiency exists due to the reluctance of traditional lenders to invest in small business; and many alternative lenders not having the necessary liquidity or funding to provide sufficient lending to UK SMEs to drive their ESG performance. This is a structural issue that requires government intervention to correct a current market failure.

2. The solution

The UK’s small business community needs to benefit from greater accessibility to funding to improve their ESG performance. The key pillar to our proposed solution is a government-led initiative that facilitates greater liquidity in the SME lending market and is targeted on ESG initiatives, especially the environment and carbon reduction.

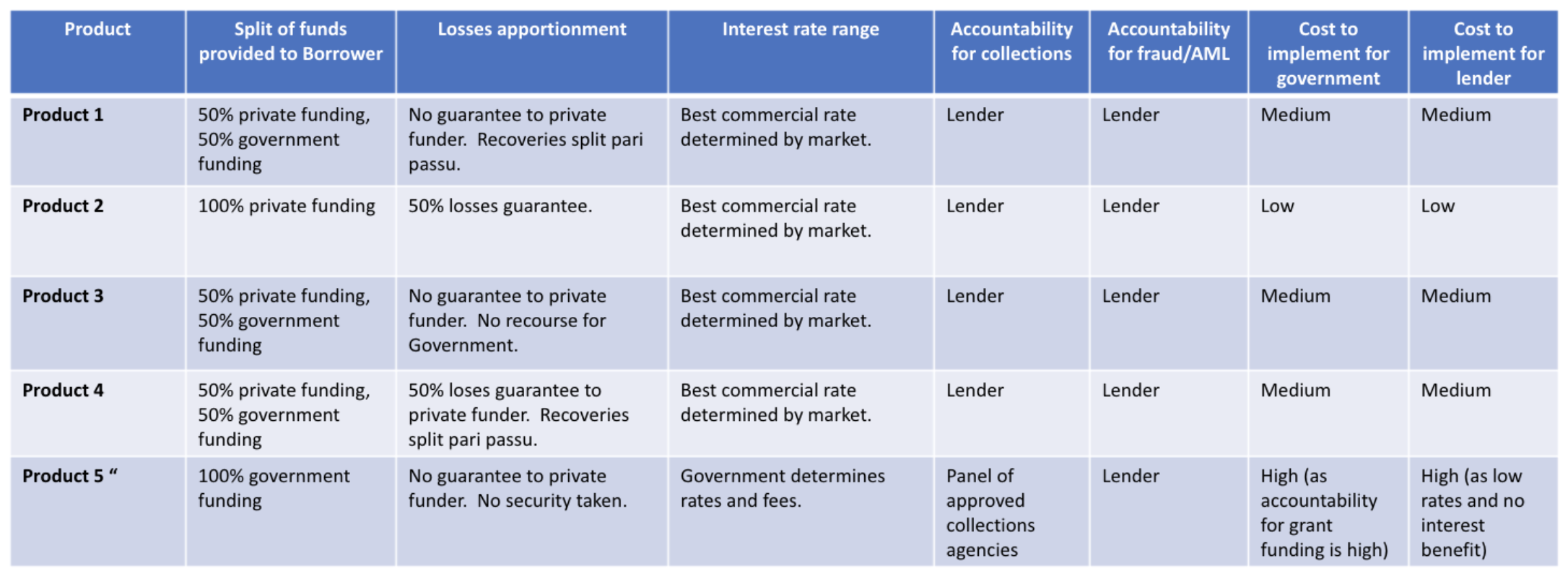

Five variations of potential Green Loan products for SMEs are set out in Appendix 1, but in summary they predominantly relate to either:

a) A government-backed guarantee (i.e. 50% of losses) in respect of eligible commercial ESG-related lending to small businesses, administered through the UK Infrastructure Bank or the British Business Bank. Similar to the government guarantees provided under the Covid loan schemes, a guarantee for ESG lending will (amongst other things) enable SME lenders (from banks to alternative lenders) to have greater access to institutional funding, which in turn will provide businesses with an increased ability to fund their ESG objectives; and/or

b) An ESG Lending Pool, being a government fund for lending that is match-funded by institutional private capital, for lenders to originate loans to ESG-oriented business and/or for ESG-related purposes. The government capital could be raised through the new NS-I bond, UK Infrastructure Bank, and/or other government sources. The private capital would be raised through lenders’ current sources of capital, which may include pension funds and green bonds secured over normal small business lending collateral.

3. The Impact

a) Commercial loans, with a 50% government-guarantee

Following the precedents of CBILS, BBLS and RLS to support small businesses, a 50% losses guarantee would stimulate increased commercial investment in small businesses adopting ESG-related projects, policies and procedures. In summary, the main benefits would be:

Most lenders take into account recoverability when pricing a loan. A 50% losses guarantee would make commercial lending cheaper for ESG-related purposes.

Recoverability (or lack of) is often a reason a lender will decline a loan application. With 50% covered by the UK Government, commercial investors would be more inclined to participate in the loans. This would create more net lending to SMEs for ESG-related purposes.

The availability of loans eligible for this scheme would drive the ESG conversation in the small businesses community and incentivise small businesses to orient themselves more towards ESG in time for future funding requirements.

Further details on how the scheme could be administered are set out in Appendix 2 (Eligible Lenders and Eligible Loans).

b) ESG Lending Pool, match-funded with private investment

Since BBLs, CBILS and RLS entered the small business market in 2020 and 2021, there has been a shortage of commercial funding available, especially for younger small businesses and/or those with higher credit risk. This proposal aims to create affordable funding available for all credit-worthy small businesses who are focussed on ESG.

A match-funded ESG Lending Pool would stimulate pension funds and other large funders to provide funds for small businesses in the UK through securitised financial products on the capital markets. Further, the creation of an ESG Lending Pool would encourage more alternative lenders to reconsider their own ESG credentials.

The government funding could be raised through the NS-I Green Bond, UK Infrastructure Bank or another source of government-related funding. If the government funds were from NS-I or UK Infrastructure Bank then a fair interest rate could be applied to the UK Government’s contribution to cover the government’s administrative costs, inflation and offsetting some credit-related losses. This would naturally drive down the pricing for the SME customer.

APPENDIX 1 - PRODUCT PROPOSALS

For eligible small businesses, the proposal is for commercial alternative lenders to facilitate loans of up to £1m over a period of 6 months to 4 years. The loans will be supported by personal guarantees and security (where required), since the lender will provide the UK Government with an indemnity for third-party fraud, and will take on 50% of the credit risk (in all but Product 5).

Risks, and the importance of commercial competitiveness

A criticism of BBLS and CBILS was that higher credit risk companies were not able to access the funding they needed - when progressive and higher credit risk companies create the fastest and most successful growth in the UK. These are also the small businesses that support larger infrastructure projects, which Green Finance is currently geared up for.

Our proposal is for ESG-related lending to be on normal commercial terms set by each lender to ensure that lenders act responsibly when providing funding under the scheme; and so that higher credit risk businesses are not excluded from the scheme. Accordingly, a control on pricing could be that certain accredited platforms, such as Funding Options, ensure that the borrower obtains a fair market rate for the ESG-related loan.

Also to encourage wider lending to more innovative businesses, our proposal is for lenders to be permitted to take security and personal guarantees to mitigate their credit risk (since personal guarantees significantly reduces credit abuse). As part of this, lenders should be liable for any UK Government contributions where there has been third party fraud, clear credit abuse or otherwise where the lender has breached its own lending criteria.

It is our overriding objective to create a new normal competitive environment for alternative lending to small businesses where ESG principles are key for risk assessment and competitive commercial terms. When the government scheme ends after 1-2 years, we want to have created a new marketplace and customer expectation that continues sustainably, with market forces continuously increasing the competitiveness of ESG-related financial products for small businesses.

APPENDIX 2 - ELIGIBLE LENDERS AND ELIGIBLE LOANS

These proposals set out the basic criteria for Eligible Lenders and Eligible Loans. It is important that the process is not too expensive to administer as the costs will ultimately be put on the borrower. However, a fair and reasonable level of transparency and accountability is vital:

The Green Loan Scheme will utilise cloud & API services that help companies trace their carbon footprint, from the start to the very end of their supply chain; and come up with offset solutions quickly. (https://www.carbonfootprint.com/ // https://www.avarni.co/ // https://www.greenr.com/ // https://www.diginex.com/).

To qualify for being an eligible lender:

The lender could be accredited as an eligible ESG lender by the UK Infrastructure Bank, the UK Centre for Greening Finance and Investment, or the British Business Bank. Such accreditation would require a clear demonstration of the lender’s own ESG values and practices.

The lender should not change its lending criteria when making an ESG-loan in respect of affordability analysis (no lender should make unaffordable loans).

The lender may make some adjustments in its risk model in respect of coverage for recoverability.

The lender would be financially responsible for any third-party fraud, clear credit abuse or breaches of normal AML / KYC requirements.

To qualify for an eligible loan, the borrower must be able to evidence that:

The purpose for which the loan will be applied has a clear ESG purpose which is measurable and will be reported on; and/or

The borrower is carbon neutral (or carbon negative) to the reasonable satisfaction of the lender; and/or

The borrower carries out core activities in a sustainable and environmentally responsible manner, including in respect of use of renewable energy, energy conservation, recycling of waste; and/or

The core commercial activity carried out by the borrower has a clear ESG purpose, such as for environmental conservation or developing social projects such as in relation to affordable infrastructure, affordable housing, sustainable food systems or socioeconomic advancement and empowerment.

APPENDIX 3 - ABOUT US

This proposal has been put together by Swishfund Ltd and Funding Options Ltd acting together in an informal partnership, simply because both believe ESG needs to be supported and galvanised by the UK Government acting through commercial alternative finance providers.

Swishfund

Swishfund is an alternative lender to small businesses in the UK (and Netherlands), which is also carbon-negative. The UK business offers APR discounts to carbon neutral customers (as a kind of sustainability-linked bond, but for small businesses), and offsets 10 tons of carbon for all new customers. We are developing a small business environmental-responsibility scorecard, which we hope will help us make even better credit decisions. We have developed neuro-diverse loan documentation, and recorded aural versions of our contracts to help dyslexic and sight-impaired customers. We have slowed down the lending process, as we believe that fast finance is not always fair finance, by offering a 48 hour cooling off period to all direct customers. We also believe that lending is a partnership, rather than a one-off sales transaction, and take a compassionate and long-term view with customers in financial distress.

Funding Options

Funding Options launched the first “Green Finance” marketplace within the UK and the Netherlands. This reinforces Funding Options’ commitment to drive sustainability in the SME lending market by connecting businesses to the funding they need to help them reach net zero. Funding Options’ initiative compliments the UK Government’s “Together for our Planet” campaign which is urging SMEs to take small and practical steps to cut emissions in the run up to the UN Climate Summit COP26. Companies can access funding through the Green Finance marketplace to facilitate the purchase of ‘green assets’ - for example, solar panels or clean vehicles. Lenders will also be matched with ‘green businesses’ displaying strong environmental credentials, such as those participating in renewable, low/zero carbon or sustainable activities. The platform will connect ‘green businesses’ - those providing verifiably sustainable products, services or working on a green project - with the right funding partner. Additionally, a business can choose to only receive funds from a vetted “green lender”.

Get green financeSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.