News

Government Announces Recovery Loan Scheme Extension

24 Aug 2022

The Recovery Loan Scheme was introduced by the government to help SMEs recover and grow as the UK began its economic recovery after COVID-19. On 20 July 2022, the Government announced the latest iteration of the Recovery Loan Scheme (RLS), set to run for 2 years from 1 August 2022.

Recovery Loan Scheme Extended for 2 More Years

The Recovery Loan Scheme was introduced by the government to help SMEs recover and grow as the UK began its economic recovery after COVID-19. On 20 July 2022, the Government announced the latest iteration of the Recovery Loan Scheme (RLS), set to run from 1 August 2022 until 30 June 2023. Yet, the British Business Bank has only accredited a small number of lenders, thus RLS loans are therefore is not available to most customers right now.

The third RLS version will, as before, provide support to businesses, but there are some key differences from previous versions of the scheme.

Under this latest version of RLS, lenders must attempt to underwrite any finance application with their own market-based lending product first before they can consider offering an RLS loan. Also, lenders will primarily use RLS to only fund businesses that would not otherwise meet their lending criteria. This could be due to their underwriting factors such as business credit score, trading time, turnover or homeowner status.

As such, if you're considered a low-risk business, lenders will attempt to support you using their standard product selection before looking at RLS.

Lenders must certify that they wouldn’t have been able to provide finance to the business under normal commercial terms – or albeit only with high interest rates. Meaning, that RLS will act as an extension of lenders’ standard product range.

The new Recovery Loan Scheme at a glance:

Available to SMEs only with a turnover cap of £45M

Government guarantee for lenders is 70%

Personal guarantees are at the lender’s discretion, however, they are almost certain to be taken by lenders

Delivered through four finance types

Term loans (£25,001–£2 million, up to 6 years)

Overdrafts (£25,001–£2 million, up to 3 years)

Invoice finance (£1,000–£2 million, up to 3 years)

Asset finance (£1,000–£2 million, up to 6 years)

Are you eligible for non-RLS funding?

Lenders must look to support businesses under their standard products first. Failing that, they can use the RLS Government Guarantee to provide additional security to enable them to lend.

Much like the old Enterprise Finance Guarantee Scheme (EFG), the new RLS allows lenders to support businesses they previously couldn’t due to their credit score, trading time or homeowner status.

The Government will continue to guarantee 70% of the lender’s liabilities and the maximum funding amount still stands at £2million.

Previously, personal guarantees (PGs) were permitted only for facilities above £250,000. This time around, PGs will be permitted for facilities under £250,000 too. PGs are at the lender’s discretion, however, it’s likely that they will be required. This brings the scheme in line with the standard commercial practice in business lending.

Principal private residences may not be used as security under any circumstances.

Is RLS the best option for me?

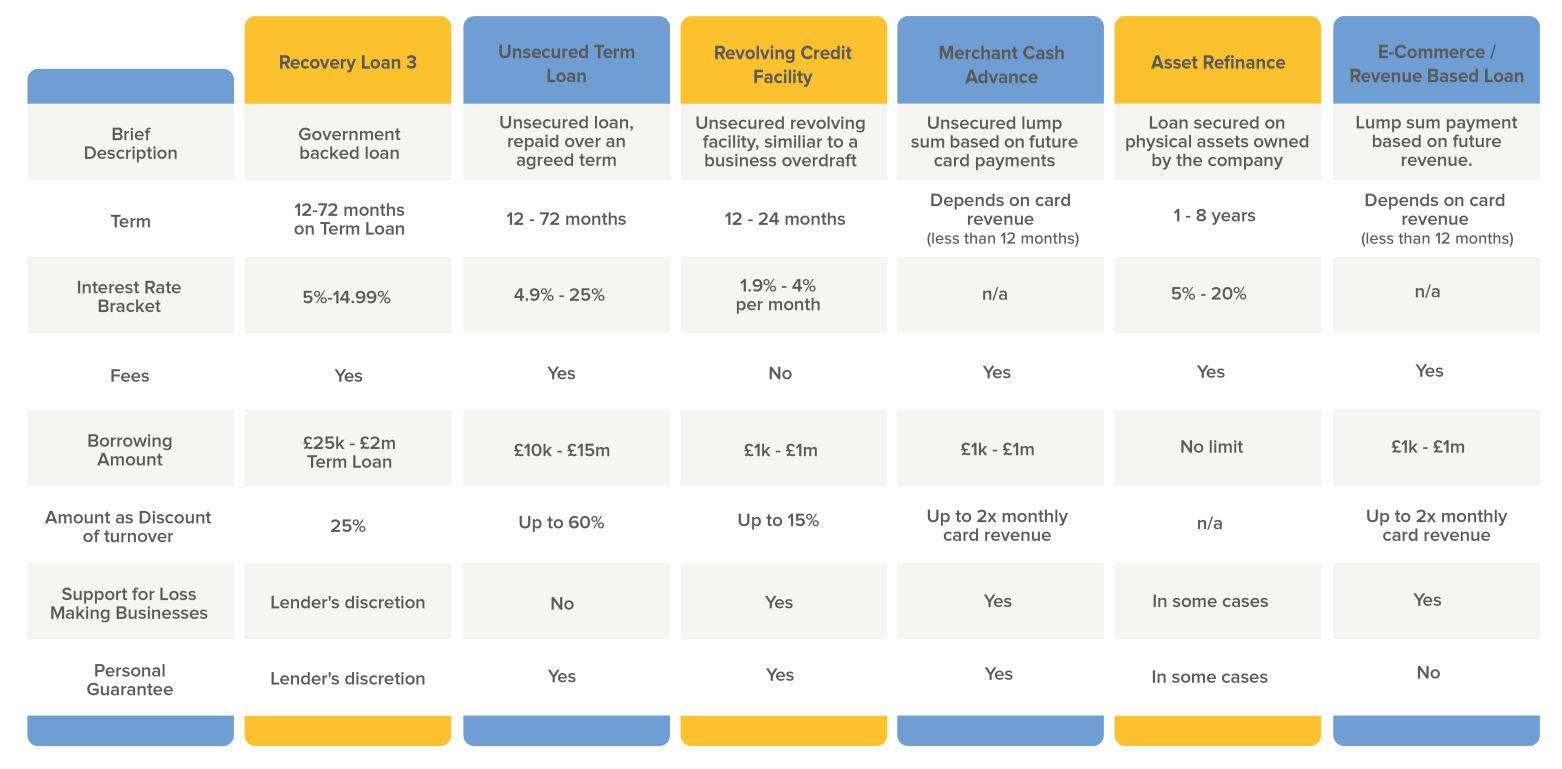

In many cases, alternative lending products offer more choice and control compared with the RLS. Businesses may be able to borrow more than they would through the scheme, and might also benefit from better interest rates. What’s more, there’s a much broader selection of non-RLS product choices out there to choose from.

What types of funding options are available now and what are their benefits?

Unsecured term loans are perfect for businesses that don’t have assets to offer for security but need funding quickly. With lenders on the market providing loans up to £20m, there are many options available. Apply now.

A Revolving credit facility is a highly flexible funding solution that allows you to withdraw money, use it to fund your business, repay it and withdraw it again. Apply now.

Merchant Cash Advances are a highly innovative finance product. The lender provides a cash advance which is repaid as a percentage of card terminal takings. Apply now.

Asset finance is a convenient way of borrowing money using a company's balance sheet assets (inventory, accounts receivable) as security to take out a loan. Apply now.

Invoice finance is a way of borrowing money based on what your customers owe to your business. It eliminates payment delays and safeguards your cash flow. Apply now.

Use Funding Options to apply

You can apply for a range of alternative finance options through the Funding Options platform. We’ve been chosen by the British Business Bank as a platform to find both RLS and non-RLS finance for UK businesses. Just tell us how much funding you require and what it's for, and we’ll ask for some basic information about your business.

Based on the information you provide, we’ll compare 120+ lenders and match your business with the right finance options for its needs. Start your funding journey now.

Apply todaySubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.